Fanatics is committed to supporting your financial well-being — today and tomorrow. The Fanatics 401(k) Retirement Savings Plan helps you prepare for retirement by offering an easy, tax-advantaged way to save for your future financial needs.

Key advantages include:

- Company match on the first 5% of your pay you contribute (available after one year of service)

- Current tax savings on pre-tax contributions, or tax savings upon distribution with Roth 401(k) after-tax contributions

- Tax-deferred investment growth

- Wide range of investment choices with options for those who prefer a hands-on approach and for those who want a ready-made investment strategy

- Convenient payroll deductions

Manage your account

Visit the Fidelity website to enroll or manage your plan account. You can:

Enroll in the plan

Check your balance

Change your contribution rate

Manage your investments

Update your beneficiary

Use planning tools and calculators

Access forms and documents

Who’s eligible?

All US employees are eligible for the Fanatics 401(k) Retirement Savings Plan unless excluded from participation by a collective bargaining agreement. You can participate on the first of the month following or coinciding with your employment start date. You become eligible for the company matching contribution after you have completed one year of service.

You may contribute between 1% and 100% of your eligible pay to your plan account through payroll deduction, up to annual IRS limits. In 2024, the IRS limits allow you to contribute up to:

- $23,000 if you are under age 50.

- $30,500 if you’re age 50 or older this year (which includes an additional $7,500 in catch-up contributions, made as a separate dollar amount election).

Pre-tax vs. Roth after-tax : What’s the difference?

The Fanatics 401(k) Retirement Savings Plan gives you the flexibility to save for retirement in a variety of ways. You can make pre-tax contributions, Roth after-tax contributions, or a combination of the two.

Pre-tax contributions

The money goes into your account before taxes are deducted, so you keep more of your take-home pay.

Because you don’t pay taxes at the time you contribute, you’ll owe taxes on both your contributions and any investment earnings when you withdraw your money in retirement (when you may be in a lower income tax bracket).

Roth after-tax contributions

The money goes into your account after taxes are withheld.

Your after-tax contributions can always be withdrawn tax-free.

Any associated earnings on your contributions can also be withdrawn tax-free, provided you meet two requirements:

- At least five years have elapsed since your first Roth contribution.

- You are at least 59½ or the withdrawal follows death or total disability.

Catch up!

It’s not too late to make up for lost time. If you’ll be 50 or older this year, take advantage of the opportunity to contribute up to an additional $7,500 in catch-up contributions.

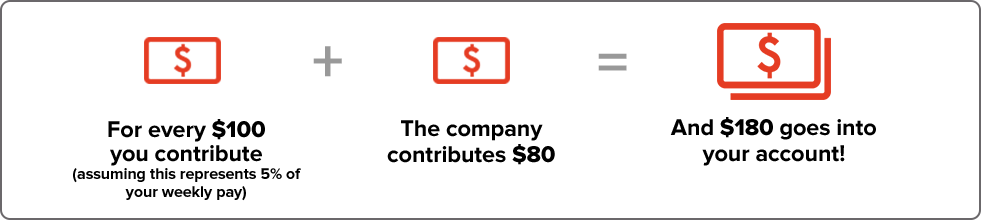

To support your retirement saving efforts and help you reach your goals, Fanatics will make matching contributions to your account each pay period. You are eligible to begin receiving the matching contribution after you have completed one year of service. Once you’ve become eligible, Fanatics will match 100% of your contributions up to 3% of your eligible compensation, and 50% of the next 2% of your eligible compensation you contribute (up to a maximum company match of $13,800 for the 2024 calendar year).

Here’s how the company match works if you contribute 5% of your eligible compensation:

Meet the match!

Try to contribute at least 5% to take full advantage of the match — otherwise, you’re saying “No, thanks” to free money.

Vesting is another way of saying “how much of the money is yours to keep if you leave the company.” You are always 100% vested in your own contributions and any company matching contributions, including any investment gains and losses on the money.

If Fanatics elects to make a discretionary profit-sharing contribution to your account, those funds will vest over four years.

Have you named a beneficiary?

It’s important to designate a beneficiary to receive the value of your Fanatics 401(k) Retirement Savings Plan account in the event you die before beginning to receive your benefit. As personal circumstances change, be sure to keep that information up to date. Visit the Fidelity website to add or change a beneficiary.

The money in your account is intended as a long-term investment to help you prepare for your financial needs in retirement. However, under certain circumstances, you may be eligible to take a loan from your Fanatics 401(k) Retirement Savings Plan account, but there are tax implications for doing so. You may take out up to two loans at any given time; however, if you have two loans open, and pay one of them off, you must wait fourteen days before opening a new loan.

For more information, visit the Fidelity website or call 800.835.5095.

Think before you act

If you’re considering taking a loan from your plan account, be sure to think about the impact it may have on your financial future.

- Taking money from your account now may lead to a smaller savings balance when you retire.

- Not only are you taking money away from your retirement savings, but the burden of repaying the loan may make it even harder to get back on track.

- If you take a plan loan, you’ll also lose more money to taxes because the interest payments on your loan are made with money that has already been taxed, and it will be taxed again when withdrawn from your account.

- If you withdraw pre-tax money from your plan account, in addition to paying current taxes on the money, you may have to pay an additional 10% penalty tax if you are younger than age 59½ (or, age 55 if you have retired or left the company).

Make the most of your retirement planning by taking advantage of these tools and resources:

- Contribution calculator — Estimate how much you could accumulate in your retirement plan over time by increasing the amount that you contribute from each paycheck.

- Roth 401(k) modeler — View hypothetical scenarios showing some differences between Roth deferral and a pre-tax deferral.

- Needs estimator — Log in to your online account to estimate how much income you may have — or need — in retirement.

- And much more! Visit the Fidelity website to get started.

Before investing, carefully consider the funds’ or investment options’ objectives, risks, charges, and expenses. Call 800.835.5095 for a prospectus and, if available, a summary prospectus, or an offering circular containing this and other information. Please read them carefully.

Investing involves risk, including the risk of loss.